One can sympathize, to a degree, with Mr. Joshua Hay. Testifying before a subcommittee whose average legal IQ hovers somewhere between “parking ticket” and “TikTok terms of service,” the president of the Hope Florida Foundation admitted, with visible humility, that the organization “made a mistake” by not filing its IRS Form 990.

A noble admission—if only it were true.

Because here's the inconvenient fact buried beneath all the legislative melodrama: no 990 was due. Not yet. Not legally, not procedurally, not even under the elastic definitions favored by journalists chasing Pulitzer prizes through hurricane extensions. What President Hays mistakenly called “delinquency” was, in reality, nothing more than a premature narrative—one so politically useful, it was apparently irresistible to a Legislature desperate to halt SB 1144 and discredit the only welfare program in Florida that didn’t need a lobbyist to function.

There are two types of legislators in this world: those who read IRS regulations and those who read headlines about IRS regulations. Florida’s Legislature, true to its brand, appears to have formed a bipartisan consensus around the latter.

Over the past week, a singularly absurd obsession has gripped the Capitol: Where is Hope Florida’s IRS Form 990? One might think a rogue agency had misappropriated billions, or that Casey DeSantis had stuffed a 990 in a cigar box and fled to Paraguay. But no—the panic stems from a nonprofit that hasn’t even reached its first actual filing deadline.

Let me break down this farce.

🧾 The Filing That Wasn’t Late, But Was Loudly Condemned

First, some facts. (Trigger warning: this may offend those allergic to tax law.)

The Hope Florida Foundation was incorporated on August 25, 2023.

According to its IRS determination letter, it uses a fiscal year-end of August 31.

That means its first full fiscal year concluded on August 31, 2024.

The standard filing deadline for a 990 following that close would be January 15, 2025.

BUT, thanks to the small matter of two hurricanes—Helene and Milton—the IRS granted every Florida nonprofit an automatic deadline extension to May 1, 2025.

In other words: The 990 isn’t late.

It isn’t even due yet.

And yet, half of Tallahassee is running around like they’ve uncovered the Nixon tapes in a Chick-fil-A bag. They do this for a reason: They’ve got a nothing burger and their hoping that at least they can make it seem like it smells like they’re cooking something. Hope Florida Foundation President Joshua Hay was not lying when he referenced a delinquency, but only wrong in his terminology as he attempts to be as honest and direct about the foundation during questioning.

📞 Journalists and Legislators Who Failed IRS 101

Let’s begin with the journalists—since they laid the foundation (badly) for this manufactured outrage. Reporters such as Lawrence Mower, too lazy to visit a government office or consult a calendar, have taken to social media to decry the absence of a form that isn’t required to exist yet. He also intentionally avoided going to the very state offices he could have asked about. In fact his biggest gripe was not having access to them via internet and that he might have to get up and do something for once.

Then came the lawmakers—mouths agape, subpoenas in hand—who, without a hint of irony, demand criminal investigations into what amounts to a paperwork deadline that hasn’t passed.

What Hope Florida is guilty of, apparently, is not fraud or misuse, but of failing to satisfy the whims of journalists who think Form 990 is a menu item at a Gainesville bistro.

🤹 The 990-N and the Six-Day Panic

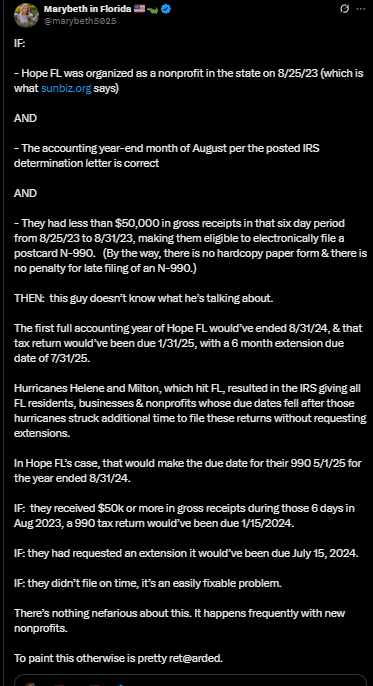

If Hope Florida received less than $50,000 in receipts during its first six days of life (August 25–31, 2023), it qualified for a Form 990-N, the IRS’s electronic postcard. This is the nonprofit version of checking in at a doctor’s office: a digital “yes, we exist.” As Marybeth in Florida a spacehost and accountant on Twitter highlighted:

The 990-N:

Cannot be filed on paper

Is submitted electronically only

Has no penalty for late filing

Is not required to be displayed at the nonprofit’s private office for drive-by journalists seeking gotcha moments

But for the critics understanding this would require a level of intellectual curiosity that, alas, cannot survive in a Tallahassee press room where political operatives and media barons trade headlines like cocktail napkins.

🎭 The Real Show: The Legislature’s Performance of Outrage

Now let’s turn to the Legislature, whose indignation over the “missing 990” might be mistaken for sincerity if they hadn’t just voted themselves $57 million in support services from the general fund.

So I’m as clear as can be:

It came from a Centene settlement

It was used for grants to community nonprofits

And the IRS deadline for disclosure is still two weeks away

Meanwhile, these same legislators overrode the Governors veto restored tens of millions of taxpayer dollars to their own salaries, staff, travel, IT systems, and almond milk subsidies (or whatever it is they now demand to function), and did so without a single hearing on ethics or transparency.

Yet it’s Hope Florida that must now endure subpoenas and smear campaigns for failing to complete a filing that wasn’t yet required.

If irony were taxable, the Florida Legislature would eliminate the state income tax.

💼 The Illusion of Malfeasance

The question is not whether these lawmakers are stupid, I mean most of them are. The question is whether they believe you are.

They know the 990 isn’t late.

They know the IRS granted an extension.

They know most new nonprofits have administrative delays—especially those that scale quickly.

But they also know that a fabricated scandal can be used to:

Delay SB 1144, the bill that would make Hope Florida permanent

Tarnish Casey DeSantis’s record ahead of a possible run for governor

Protect the consultant class from another eight years of being held accountable by a competent executive

This isn’t about law. It’s about fear.

The kind of fear that creeps into the hearts of mediocrities when someone shows what governance looks like.

🐊 Collateral Damage in the Defense of Mediocrity

Hope Florida’s real sin was success.

It helped 30,000 Floridians, bypassed red tape, empowered churches and local groups, and did it all without a single legislative middleman to cut the ribbon or cash the check.

It was effective conservatism, and it dared to succeed without permission.

So now the state’s political machine is attempting to bury it in process crimes and paperwork theater.

Hope Florida is collateral damage in the defense of mediocrity—the one institution Tallahassee will never underfund.

🧨 Final Word from Croaky

What you are witnessing is not a scandal. It is a tantrum with a committee assignment.

It is the theatrical wail of a political class that has been outperformed by a First Lady armed only with a vision and a spreadsheet.

So yes, the 990 is coming.

And when it does, I hope it comes stapled to a subpoena of every lawmaker who voted for $57 million in self-funding and dared to scream “transparency!” on the way out.

Read SB 1144. Know the facts. And stop letting yellow journalists dictate the color of your outrage.

Want more clarity in a world of clutter? I cover these topics—and the intellectual battles behind them—on Substack: The Rational Purview

🟩 Subscribe.

🎙 Listen to Firing Lane.

☕ Support the anti-grift with a Buy Me a Coffee.

🛍 Check out @MrsCroaky’s merch store.The fight for reason isn’t won in a day. But we can win it one argument at a time.

Share this post